Ontario’s housing market in 2025 is shaped by higher mortgage rates, evolving government policies, and ongoing supply shortages. Here’s what property owners, buyers, and investors can expect.

1. Mortgage Rates

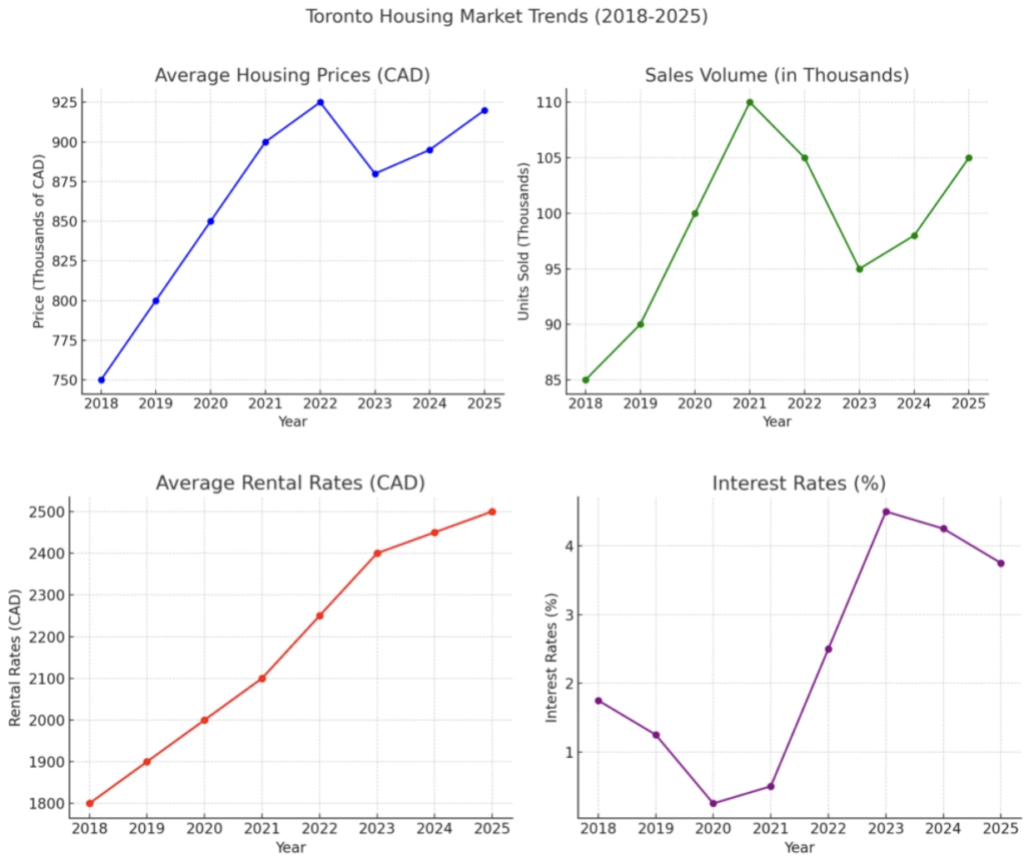

Mortgage rates are expected to remain higher than previous years, affecting affordability for homebuyers. This may lead to greater demand for rental properties, particularly multi-family units, as more people turn to renting due to higher homeownership costs.

2. Government Policies

The Ontario government is focusing on increasing housing supply through incentives for developers and relaxed zoning laws. This could benefit multi-family property owners by opening up new opportunities for construction and renovation.

3. Supply and Demand

Despite efforts to build more homes, Ontario still faces a housing shortage. This has driven up prices and kept rental demand high, especially in cities like Toronto and Hamilton. Multi-family properties in central locations will continue to be in high demand.

4. Shifting Demographics

Millennials and Gen Z are increasingly renting, with many seeking affordable, flexible housing. Multi-family properties in urban centers or accessible suburbs will see continued demand as people prioritize convenience and space.

5. Strong Rental Market

The rental market remains robust as homeownership becomes less attainable. Multi-family property owners can expect steady demand for rental units, though rising costs may push up rent prices.

In conclusion, Ontario’s housing market in 2025 presents both challenges and opportunities. Investors in multi-family properties can capitalize on growing rental demand while keeping an eye on market shifts and government policies.