Investing in multi-family properties can be a lucrative way to generate passive income and build long-term wealth. In cities like Hamilton and Toronto, the demand for rental properties is consistently high, making it an attractive option for investors. Here’s a brief guide to help you get started with multi-family real estate investment in these Ontario cities.

1. Understanding Multi-Family Properties

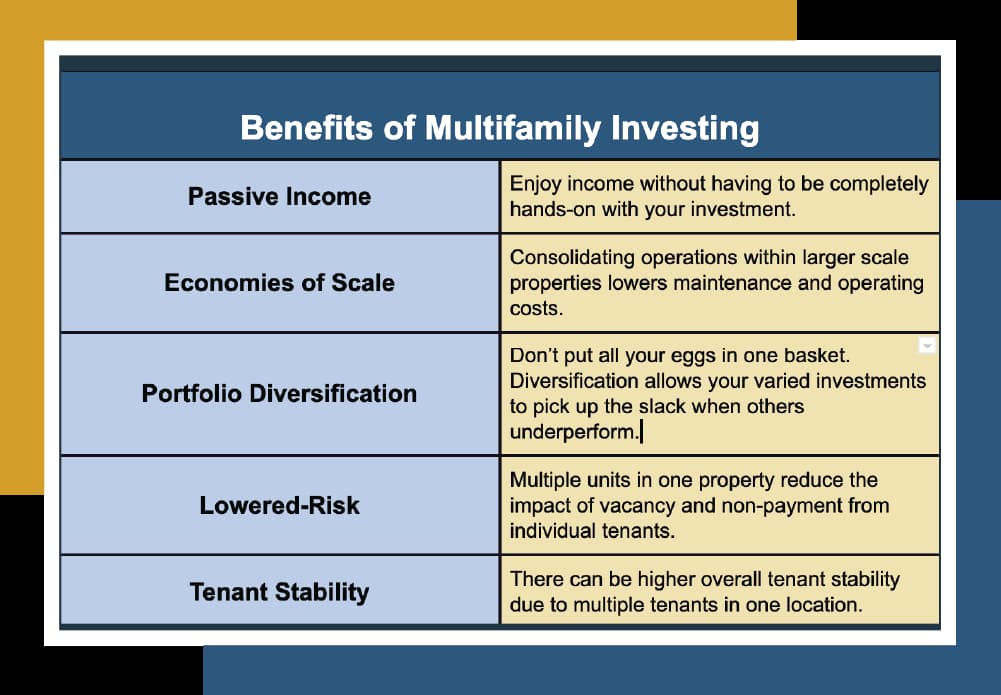

Multi-family properties are residential buildings that house more than one family unit, such as duplexes, triplexes, apartment buildings, and condominiums. These properties allow you to rent out individual units, generating multiple streams of income from a single investment.

2. Why Hamilton and Toronto?

Both Hamilton and Toronto have strong rental markets, driven by growing populations, a steady influx of immigrants, and a robust job market. Hamilton, known for its lower property prices compared to Toronto, presents an opportunity for those seeking to enter the real estate market at a lower cost. Toronto, as Canada’s largest city, offers a high demand for rental properties due to its business hubs and cultural attractions.

Hamilton:

- Population Growth: Hamilton’s population has been growing steadily, and with the city’s ongoing development, there’s a rising demand for rental properties.

- Affordable Investment: Property prices in Hamilton are more affordable compared to Toronto, allowing investors to purchase larger or more units with the same budget.

Toronto:

- Higher Rent Potential: Due to its high population density and economic opportunities, Toronto offers higher rental income.

- Long-Term Capital Appreciation: Toronto has historically seen significant property value increases, making it a prime location for investors seeking long-term returns.

3. Types of Multi-Family Properties

- Duplexes/Triplexes: These properties are smaller, making them easier to manage. They are perfect for beginner investors.

- Apartment Buildings: Larger properties with multiple units, providing higher rental income but requiring more capital and management effort.

- Condos: A more accessible option, especially in Toronto, where high-rise buildings dominate the skyline.

4. Key Considerations Before Investing

- Location: In both cities, location is key. Look for properties near public transit, universities, or business centers to attract tenants.

- Financing: Depending on the property size, you may need to secure financing. Be prepared to provide a solid business plan and credit history.

- Property Management: Managing multiple tenants requires a solid system. You can either manage the property yourself or hire a property management company.

- Legal and Tax Considerations: Ensure that you are aware of the local zoning laws, rent control regulations, and property tax rates. Consulting with a real estate lawyer is advisable.

5. Financing Your Investment

To finance your multi-family investment, you can use several options:

- Conventional Mortgages: Available through banks, these are the most common way to finance multi-family properties.

- Private Lenders: If you have difficulty securing a conventional mortgage, private lenders may be an option, although interest rates can be higher.

- Government Programs: Look into any available programs for first-time investors or those investing in certain types of properties.

6. Property Management and Maintenance

Managing a multi-family property involves regular maintenance, tenant screening, lease agreements, and rent collection. You can either manage the property yourself or hire a property management company to handle these tasks for a fee.

7. Risks and Challenges

While investing in multi-family properties can be profitable, it’s not without risks:

- Vacancy Rates: Always factor in potential vacancies when estimating income.

- Market Fluctuations: Both Hamilton and Toronto’s real estate markets can experience ups and downs. Staying informed on market trends is crucial.

- Maintenance Costs: Large buildings can require expensive repairs, so having a reserve fund is essential.

8. Exit Strategy

As with any investment, it’s important to have an exit strategy. You can sell the property for capital appreciation or hold onto it for long-term rental income.

Conclusion

Investing in multi-family properties in Hamilton and Toronto can be a profitable venture, offering both steady rental income and potential for long-term capital appreciation. By understanding the market, choosing the right property type, and being prepared for the responsibilities of managing multiple tenants, you can set yourself up for success in Ontario’s real estate market. Whether you start small with a duplex or aim for larger apartment buildings, there’s ample opportunity to build wealth through multi-family investments.